Examples

Here you’ll find a series of example of calls to

yf_get(). Most arguments are self-explanatory, but you can

find more details at the help files.

The steps of the algorithm are:

- check cache files for existing data

- if not in cache, fetch stock prices from YF and clean up the raw data

- write cache file if not available

- calculate all returns

- build diagnostics

- return the data to the user

Fetching a single stock price

library(yfR)

# set options for algorithm

my_ticker <- 'GM'

first_date <- Sys.Date() - 30

last_date <- Sys.Date()

# fetch data

df_yf <- yf_get(tickers = my_ticker,

first_date = first_date,

last_date = last_date)

# output is a tibble with data

head(df_yf)## # A tibble: 6 × 11

## ticker ref_date price_open price_high price_low price_close volume

## <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 GM 2026-01-05 80.5 83.4 80.0 83.2 10468400

## 2 GM 2026-01-06 82.7 82.8 81.2 82.2 7972900

## 3 GM 2026-01-07 82.1 82.7 81.6 81.9 6362000

## 4 GM 2026-01-08 82.8 85.2 82.4 85.1 11643400

## 5 GM 2026-01-09 83.5 84.4 81 82.9 12142900

## 6 GM 2026-01-12 82.2 82.9 81.1 82.9 7376400

## # ℹ 4 more variables: price_adjusted <dbl>, ret_adjusted_prices <dbl>,

## # ret_closing_prices <dbl>, cumret_adjusted_prices <dbl>Fetching many stock prices

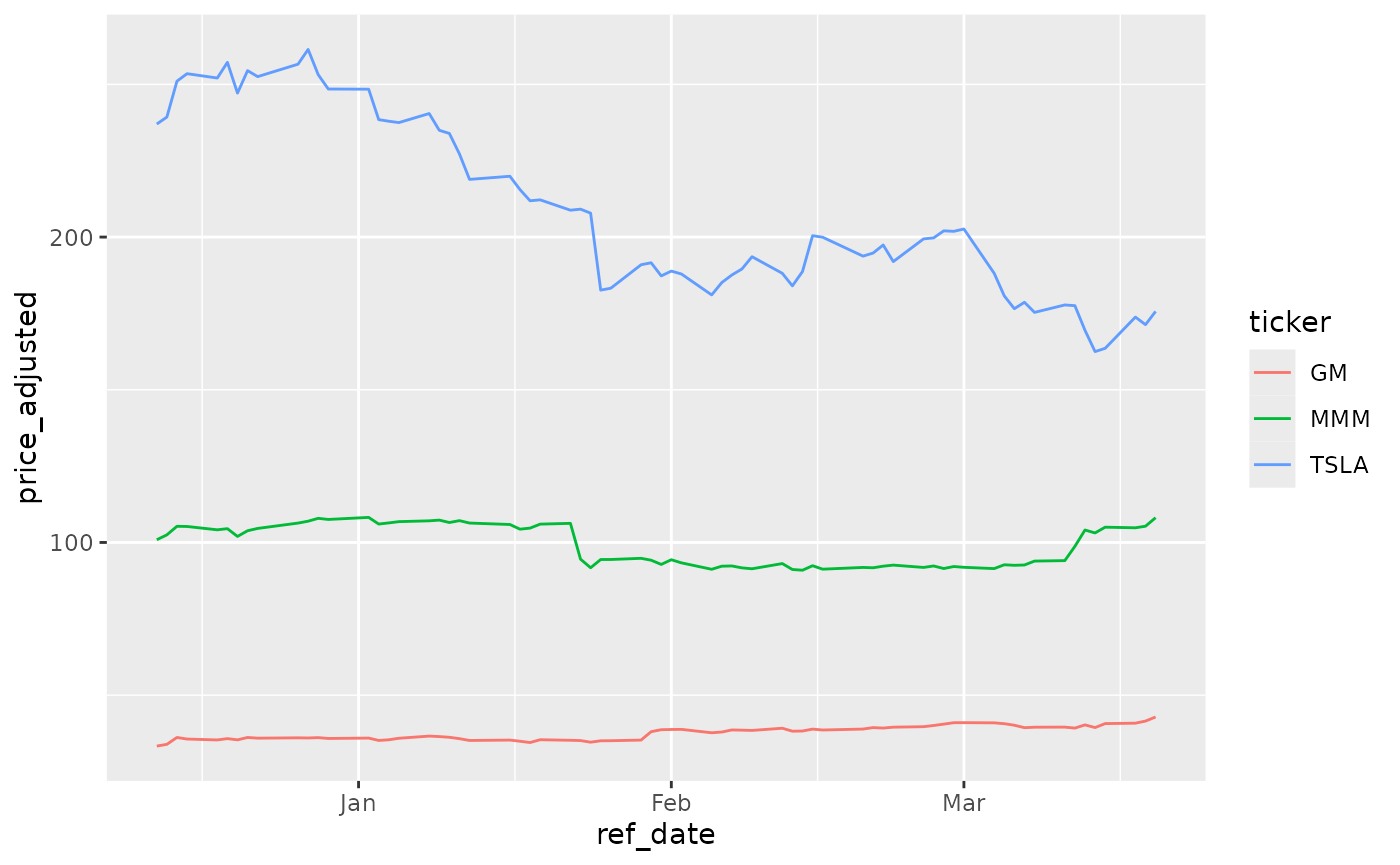

library(yfR)

library(ggplot2)

my_ticker <- c('TSLA', 'GM', 'MMM')

first_date <- Sys.Date() - 100

last_date <- Sys.Date()

df_yf_multiple <- yf_get(tickers = my_ticker,

first_date = first_date,

last_date = last_date)

p <- ggplot(df_yf_multiple, aes(x = ref_date, y = price_adjusted,

color = ticker)) +

geom_line()

p

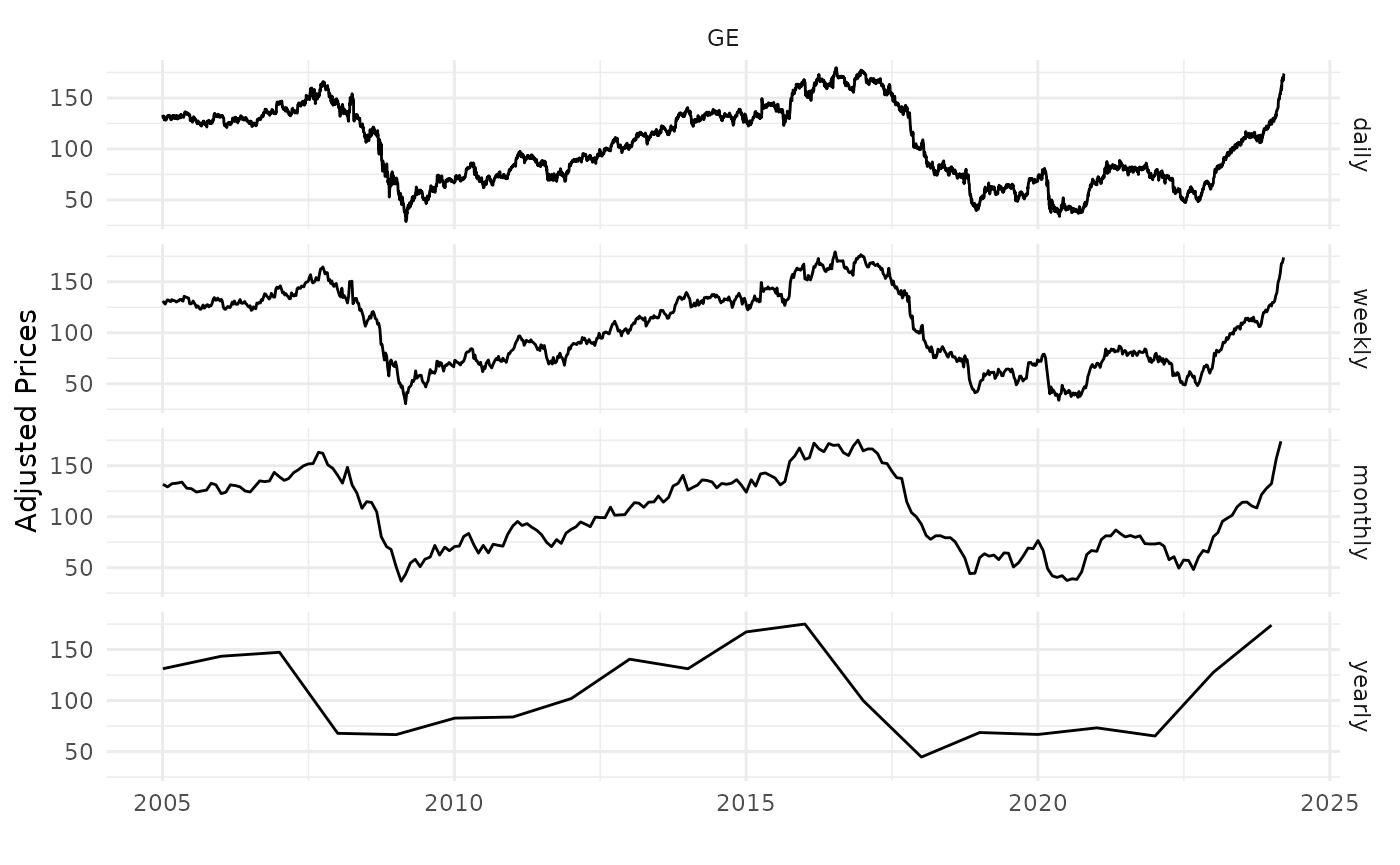

Fetching daily/weekly/monthly/yearly price data

library(yfR)

library(ggplot2)

library(dplyr)

my_ticker <- 'GE'

first_date <- '2005-01-01'

last_date <- Sys.Date()

df_dailly <- yf_get(tickers = my_ticker,

first_date, last_date,

freq_data = 'daily') %>%

mutate(freq = 'daily')

df_weekly <- yf_get(tickers = my_ticker,

first_date, last_date,

freq_data = 'weekly') %>%

mutate(freq = 'weekly')

df_monthly <- yf_get(tickers = my_ticker,

first_date, last_date,

freq_data = 'monthly') %>%

mutate(freq = 'monthly')

df_yearly <- yf_get(tickers = my_ticker,

first_date, last_date,

freq_data = 'yearly') %>%

mutate(freq = 'yearly')

# bind it all together for plotting

df_allfreq <- bind_rows(

list(df_dailly, df_weekly, df_monthly, df_yearly)

) %>%

mutate(freq = factor(freq,

levels = c('daily',

'weekly',

'monthly',

'yearly'))) # make sure the order in plot is right

p <- ggplot(df_allfreq, aes(x = ref_date, y = price_adjusted)) +

geom_line() +

facet_grid(freq ~ ticker) +

theme_minimal() +

labs(x = '', y = 'Adjusted Prices')

print(p)

Changing format to wide

library(yfR)

library(ggplot2)

my_ticker <- c('TSLA', 'GM', 'MMM')

first_date <- Sys.Date() - 100

last_date <- Sys.Date()

df_yf_multiple <- yf_get(tickers = my_ticker,

first_date = first_date,

last_date = last_date)

print(df_yf_multiple)## # A tibble: 198 × 11

## ticker ref_date price_open price_high price_low price_close volume

## * <chr> <date> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 GM 2025-10-27 69.6 69.6 68.8 69.4 9724800

## 2 GM 2025-10-28 69.5 70.2 68.7 69.9 13072200

## 3 GM 2025-10-29 69.6 70.2 68.6 69.1 10575900

## 4 GM 2025-10-30 68.7 69.8 68.4 68.7 7559500

## 5 GM 2025-10-31 68.8 69.3 68.6 69.1 6993600

## 6 GM 2025-11-03 68.9 68.9 67.8 68.2 10252300

## 7 GM 2025-11-04 68 68.1 66.8 66.9 8478200

## 8 GM 2025-11-05 67.0 69.3 67.0 68.8 7807000

## 9 GM 2025-11-06 68.7 69.4 68.2 68.8 6086300

## 10 GM 2025-11-07 68.9 70.8 68.6 70.8 8408500

## # ℹ 188 more rows

## # ℹ 4 more variables: price_adjusted <dbl>, ret_adjusted_prices <dbl>,

## # ret_closing_prices <dbl>, cumret_adjusted_prices <dbl>

l_wide <- yf_convert_to_wide(df_yf_multiple)

names(l_wide)## [1] "price_open" "price_high" "price_low"

## [4] "price_close" "volume" "price_adjusted"

## [7] "ret_adjusted_prices" "ret_closing_prices" "cumret_adjusted_prices"

prices_wide <- l_wide$price_adjusted

head(prices_wide)## # A tibble: 6 × 4

## ref_date GM MMM TSLA

## <date> <dbl> <dbl> <dbl>

## 1 2025-10-27 69.2 168. 452.

## 2 2025-10-28 69.7 166. 461.

## 3 2025-10-29 69.0 164. 462.

## 4 2025-10-30 68.5 166. 440.

## 5 2025-10-31 69.0 166. 457.

## 6 2025-11-03 68.1 161. 468.